Avantgarde Finance: Scroll Treasury Management Proposal

Table of Content

- Proposed Services’

- SCR Diversification

- Treasury Management Framework

- Earning Yield on idle SCR

- Ecosystem Synergies & Protocol Integrations

- Financial Planning & Reporting

- Summary & Expected Outcomes

- Team Overview

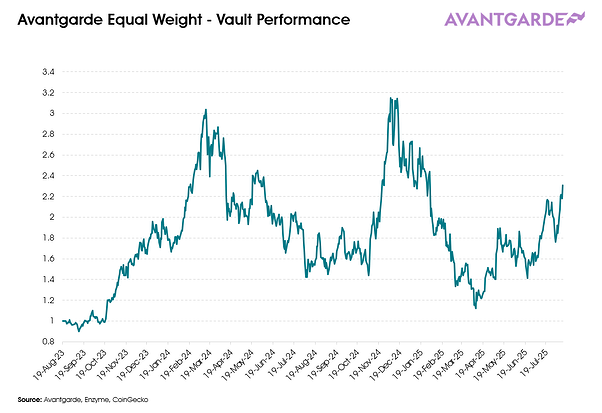

- Track Record & Case-Study Examples

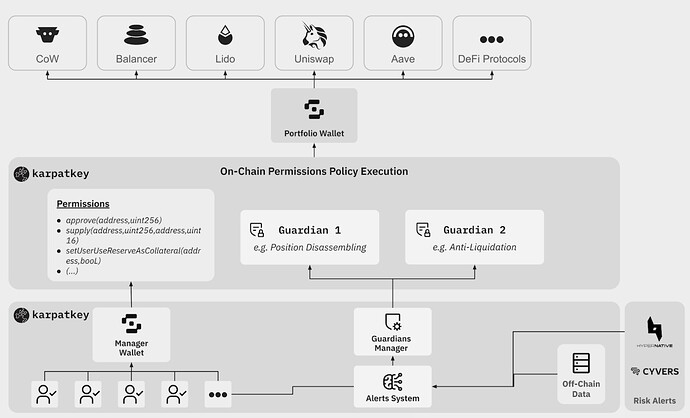

- Operational Setup & Tooling

- Pricing

- Risk Frameworks & Assumptions

- Conflict of Interest Disclosure

Proposed Services: Holistic Treasury Management

In the months leading up to the RFP, we’ve had numerous conversations with delegates in the Scroll DAO to better understand how delegates would like to see the treasury being managed and utilized. This proposal is built on the feedback we got, and is our invitation to a strategic partnership to bring holistic management to the DAO’s treasury.

The outlined approach addresses the DAO’s key objectives—extending the runway, mitigating risk, and ensuring a stable financial foundation for funding programs and contributors for years to come—but also aims to foster activity and growth within the Scroll DeFi ecosystem through strategic asset allocation and protocol deployments, to align treasury actions with the DAO’s broader strategic goals. The proposed partnership will be founded on transparent operational processes and accounting to provide not only a clear overview and point of contact for the DAO’s finances, but also the necessary financial context to make strategic decisions and structuring actionable financial plans for the DAO, whether it’s grants programs or other growth initiatives.

We would look to work closely with the DAO (or possibly the newly proposed Execution Oversight Council) to ensure that the deployed strategies accurately reflects the DAO’s current risk tolerance and overall objectives, and with the DAO’s input outline a treasury management policy framework to guide the mandate (such as the % of funds earmarked for the different strategic parts). Lastly, we are not opposed to collaborating with other service providers, if that is what the DAO prefers.

The proposed services have been divided into five parts plus a summary at the end:

-

SCR Diversification

-

Treasury Management Framework

-

Earning Yield on idle SCR

-

Scroll Ecosystem Synergies & Protocol Integrations

-

Accounting, Reporting and Financial Planning

-

Summary & Expected Outcomes

1. SCR Diversification

One of the key considerations for diversifying away from the native token is to minimize the price pressure from treasury sales. With this in mind, we propose that the Scroll DAO leverages an options strategy using on-chain protocol MYSO Finance (more on MYSO in the DApp Deployments section below) to diversify part of its SCR holdings, which backtesting shows is a superior approach compared to direct or TWAP selling. This could be done through a call-writing strategy which would:

-

Sell at-the-money call options on the pre-agreed and earmarked SCR.

-

Source bids from major market makers but settle natively on the Scroll chain.

-

Roll options in line with initial stablecoin needs and subsequent cash-flow.

We have pre-validated interest from multiple trading firms willing and able to bid on and fill options written for the Scroll DAO. For trust-minimized on-chain settlement, the MYSO v3 protocol can be utilized, as it specializes in efficient on-chain settlement of bespoke structured products for treasuries and HNWIs. This allows options to be written entirely on-chain without directly transferring SCR to trading firms. Additionally, it enables efficient liquidity sourcing and competitive bidding, ensuring the highest possible option premiums.

For a quick introduction to covered calls, read more here.

Why Covered Calls for SCR

The SCR market demonstrates significant realized and implied volatility, making it attractive for covered call strategies. The higher the volatility, the more trading firms are willing to pay for options.

The benefits of this strategy would be as follows:

-

Monetize SCR’s volatility and earn stablecoin yield upfront

-

Enable the diversification effort to be cashflow positive for the DAO

-

Cushion any moves down in the SCR price during the liquidation period because of off-setting premiums

-

Launch a new dApp on Scroll via MYSO v3 deployment

-

Settle trades natively to boost activity on Scroll

-

Stimulate trading activity and liquidity for SCR from institutional trading firms

-

Execute in a non-custodial way to avoid counterparty risk

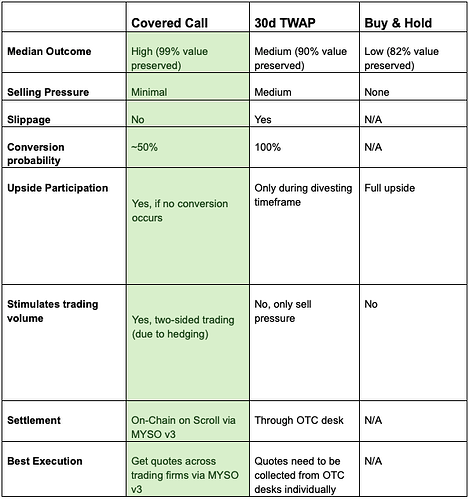

A Superior Tool for Diversification: Comparison vs TWAP

A pre-agreed amount of SCR could conveniently be diversified into stablecoins with a bespoke covered call strategy using MYSO, which would involve selling weekly at-the-money SCR call options for near-term needs and to build an initial stablecoin reserve. If, at expiry, the SCR price is below the strike, the position is rolled over and a new call is written. If the SCR price exceeds the strike, the SCR are converted into stablecoins.

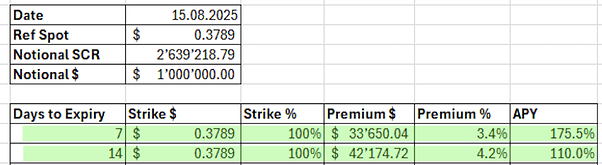

Below we showcase an example strategy based on recently validated quotes and a $1M notional, which (all else being equal) could be rolled over every 7 days to earn an additional ≈$30k for the DAO per each tranche and weekly cycle:

-

Example Notional: $1M SCR

-

Tenor: 7-day rolling

-

Strike: 100%, i.e. at-the-money

-

Estimated Premium: 3.4% notional per cycle / 175.5% APY

In reality, premiums are subject to change and may vary based on market price and volatility conditions at the time of execution, but this illustrates the general mechanics and potential of the strategy.

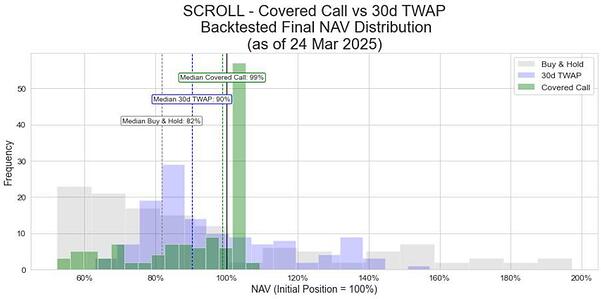

Multiple backtesting (conducted in preparation for calls with the Foundation back in March/April and again last week ahead of this RFP) indicates that this covered call strategy outperforms both a naive 30-day TWAP selling approach and a buy-and-hold strategy. Specifically, the backtests have shown that the MYSO strategy yields a higher median net asset value compared to the other approaches. If, for whatever reason, the ongoing analysis indicates a less favourable environment for MYSO utilisation, there is nothing that says we couldn’t utilise TWAP to acquire stablecoins for the DAO if needed.

An additional benefit of this proposal is that, if accepted, MYSO v3 will be deployed on Scroll at no additional cost. This will enable other large SCR holders to utilize covered call strategies and make use of the same infrastructure.

2. Treasury Management Framework

The main goal of the treasury management strategy is to improve sustainability of the treasury, in line with meeting the DAO’s long term budgeting objectives and cash flow needs. This involves a balance between longer-term growth with near-term risk reduction. Reducing the volatility of the treasury through diversification can significantly improve the sustainability of the DAO, by improving financial visibility through the accumulation of lower risk yield-bearing assets, and by enabling the treasury to act as a counter cyclical buffer so the DAO is not a forced seller of SCR at low prices when the project is most in need of liquidity.

Avantgarde will look to target a strategic asset allocation between growth and stable assets, tailored to the DAO’s ongoing needs and objectives. The target allocation is a function of risk preferences, with higher growth allocations providing higher growth potential but also more potential for near term drawdowns, and vice versa for higher stablecoin allocations. This is an iterative process which will evolve with the DAO’s financial position over time. A by-product of thoughtful diversification of the treasury is the potential for generating revenues for the DAO. Within the strategy asset allocation, Avantgarde will look to select assets with high liquidity and utility, which can complement SCR holdings by being put to work in DeFi to generate yield or to enable borrowing through usage as collateral where needed.

We will likewise take into account the SCR vesting schedule in the treasury management process, such as spreading any SCR diversification across the calendar year to ease potential sell pressure around vesting periods, integrating the schedule into the liquidity profile of treasury assets through time, and dynamically adjusting the volatility profile in a holistic manner to account for upcoming unlocks.

Strategic Asset Allocation

Our framework separates allocations into growth assets vs. stablecoin assets. Having a higher allocation growth assets such as ETH can improve the average expected outcome, but also increases the risk of more negative outcomes in the event crypto prices perform poorly over the holding period. The strategy asset allocation decision should trade off the need to preserve capital to meet near term spending versus the desire to grow the DAO’s spending power over the longer term.

Options across the Risk Spectrum

The Strategic Asset Allocation (SAA) framework spans a range of approaches across the risk / return spectrum. Without a crystal ball, the optimal allocation between growth assets and stablecoins depends on risk tolerance and the desired tradeoff between potential growth and potential worst case scenarios. Using historical data on ETH and stablecoin yields, the table below illustrates the potential distribution of 1-year returns across various market environments for allocations ranging from 0% ETH / 100% Stablecoins to 100% ETH / 0% Stablecoins.

As expected, the median return increases with higher allocations to ETH in a bull market and increasingly negative outcomes in the bear cases the higher allocation to growth assets.

To provide a more tangible understanding of the spectrum, we can categorize the SAA options as follows:

-

Conservative (30% ETH / 70% Stablecoins): Prioritizes stability while incorporating some exposure to growth assets for modest upside potential.

-

Moderate (50% ETH / 50% Stablecoins): Balances growth and stability, offering a middle-ground approach for a mix of risk and reward.

-

Growth (70% ETH / 30% Stablecoins): Emphasizes growth while maintaining some stability to manage liquidity and downside risks.

-

Aggressive (100% ETH / 0% Stablecoins): Fully allocates to growth assets for maximum upside potential but is highly vulnerable to market downturns.

The final allocation will be optimized based on the risk capacity and risk tolerance of the DAO, which would be informed by simulations-based analysis and tailored to Scroll’s objectives of extending the DAO’s runway, mitigating risk, and ensuring a stable financial foundation for long-term programs and contributors. The stablecoin balance will also provide the necessary liquidity to pay for grants and service providers, minimizing downward sell pressure and acting as a buffer during bear markets. All in all, this approach aims to strengthen the DAO’s independence, sustainability, and longevity, with the flexibility to periodically adjust allocations as market conditions and the needs of the ecosystem evolve.

Market Selection

Given the pace at which DeFi evolves, we feel it is impractical to fix the exact portfolio of markets to allocate to within governance, as yields move quickly and require dynamic allocation. Our allocation philosophy will balance a focus mostly on battle-tested protocols, while retaining some flexibility for measured allocations to more dynamic opportunities in recognition that the opportunity set could change significantly over the course of the investment horizon. This approach ensures that the treasury remains securely positioned while still able to take advantage of shifts in the market to optimize returns.

As discussed further in the Ecosystem Synergies section, we will look to allocate to projects on Scroll to aid in the development of the native DeFi ecosystem. However, there is a balance between increasing TVL and distorting supply & demand, and it is important to note that the treasury should consider the capacity of Scroll DeFi at any point in time and avoid diluting yields for users. Hence, we may utilize Mainnet for part of the yield generation initially to manage the capacity constraints, and reallocate to native DeFi deployments as it grows.

Stablecoins

For the majority of stablecoin assets, Avantgarde would look to take an active and conservative approach, focused on diversification and larger battle-tested protocols to manage capacity and smart-contract risk. This approach follows the same philosophy as that of our own Avantgarde DeFi Yield Fund (traditional fund structure for institutional investors) and Avantgarde DeFi Yield Vault (on-chain only vault for DAOs and Foundations), and we believe this approach would be in line with the risk capacity of the DAO initially, where the focus for stablecoin allocation is on risk reduction at the overall treasury level.

Where the DAO is comfortable, we would propose an allocation of the DAO’s longer term stablecoin holdings to be deployed on Mainnet to capture the broader opportunity set, deeper liquidity, and improve diversification (similar strategies are currently yielding 8% to 12% on stablecoins on Mainnet). Though the Scroll ecosystem is still at an early stage compared to Mainnet, we believe there is sufficient depth to allocate part of the strategy to the native DeFi universe, predominantly where funds are earmarked for near term liquidity needs. And we will also look to reallocate within Scroll as new opportunities emerge (discussed in the Ecosystem Synergies section).

The team has experience managing the strategy through a number of environments, including the low yield environment in second half of 2024, until the volatility of the US election, and the subsequent regime change and run up in on-chain yields. We recognise that change is the only constant within DeFi and are prepared to adapt the strategy as the opportunity set evolves.

Growth Assets

For the core allocation within the growth assets category, we will look to allocate to a diversified mix of ETH lending, staking, and fixed rate strategies, with a focus on larger and well established protocols. Though there are a number of innovations within ETH staking across the risk spectrum, the price volatility of ETH is high relative to the level of yields - historically the ETH price has driven the majority of absolute performance within the growth asset category. Hence we will run a lower risk approach focused on capital preservation for the majority of the ETH allocation, with a smaller allocation to higher risk strategies where the opportunity set is attractive.

As with the stablecoin category, where the DAO is comfortable, we would propose allocations within the Scroll DeFi ecosystem where the opportunity set is favourable and capacity reasonably allows, and the rest of the DAO’s longer term growth holdings to be deployed on Mainnet to capture the broader opportunity set and improve diversification.

3. Earning Yield on idle SCR

While diversifying into stablecoins and other growth assets like ETH will go a long way to improve the DAO’s capital efficiency and sustainability, there is still a significant opportunity cost in having the treasury’s remaining SCR tokens sit idle when they could be earning meaningful yield.

One way of doing so is to (again) utilise covered calls via MYSO, but have the strike price set far out the money (i.e., a high strike) with a low probability of conversion (based on historical backtesting), continuously rolled over while maintaining exposure to strong price appreciation. This is a strategic tool that clients of ours such as Compound and Gitcoin are utilising to earn around 10-15% APY on idle native tokens to improve revenue.

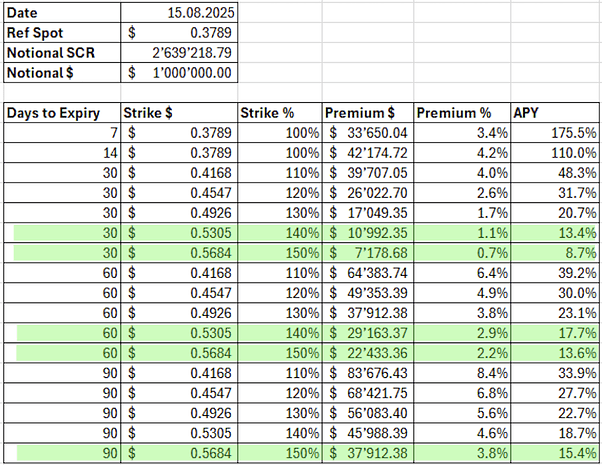

To illustrate the potential of this strategy, below we highlight some possible parameter selections based on recent quotes on a $1M notional. Again, yields will show some variation over time as they are subject to market price and volatility conditions at execution.

Running a SCR yield strategy will help improve capital efficiency on treasury assets and strengthen the DAO’s financial sustainability by providing a reliable source of revenue. Activating idle SCR this way will also help build stablecoin reserves as premiums are paid out in USDC. Given that both the Scroll ecosystem as well as the DAO is in a growth phase where new initiatives and investments are being made, the yield would help reduce depletion of the treasury as growth-initiatives and costs are potentially ramped up, and support the DAO’s ability to fund growth for many years ahead.

Funds earmarked for this strategy would be split into multiple tranches for diversification purposes and executed in a staggered manner and rolled over as they expire, targeting overall 10-15% APY while maintaining a low probability of SCR to USDC conversion, though yields could also go higher depending on the market and parameter selection at the time. USDC premiums will be deposited into the stablecoin strategy as elaborated on in the Portfolio Allocation section.

In the event that the market rallies hard and the strike is hit on any of the tranches whereby SCR gets converted into USDC, it means the DAO has secured stablecoins at a substantially higher price, which is not bad in itself. Depending on the status of the stablecoin reserves and the DAO’s cash-flow needs at the time, these would either get deposited into the stablecoin strategy or, in case the DAO has no further needs for stablecoins, be deployed back into MYSO to buy back the SCR (same strategy, different collateral, still generates upfront premiums) to then again, once bought back, be cycled back into MYSO as part of the SCR yield strategy. These factors shall be reasonably taken into consideration before selecting parameters and deploying fresh tranches of capital into the SCR yield strategy.

4. Ecosystem Synergies & Protocol Integrations

A couple of ways to stimulate ecosystem liquidity and activity on Scroll is to (1) utilise treasury assets in Scroll DeFi and (2) bring new use cases by expanding the native dApp universe through appealing protocol deployments, or a combination of both.

Treasury Utilisation & Liquidity Provision

There are a few possibilities for how the DAO treasury could be used to create synergies and improve liquidity within the Scroll ecosystem using protocol-owned liquidity. As one example, where borrow rates are attractive we can utilize treasury assets for looping strategies in a risk controlled manner, which would generate additional yield for the DAO but also increase supply rates in a way that would attract external users. Note that this is but an illustrative example and the optimal implementation routes will depend on the prevailing environment and opportunity set.

We can also facilitate a protocol owner liquidity program, where this is a blocker for specific projects in the ecosystem and the potential network effects have a high probability of offsetting the risks to the DAO’s allocated funds (such as impermanent loss).

DApp Deployments

MYSO: On-Chain Structured Products

It has been proposed that MYSO v3 is deployed to allow the DAO (and others) to leverage the benefits of on-chain structured products natively on Scroll, providing both a source of yield for SCR, a profitable means for diversifying into other assets, and enabling pooled access to on-chain option writing strategies which could make holding SCR more attractive as an asset.

MYSO is a DeFi protocol specializing in onchain structured products for high-net-worth individuals, treasuries and asset managers. The protocol enables users to earn USD income from idle tokens through bespoke covered call and cash secured put strategies. MYSO is actively being utilised by leading treasuries like Aave, Across, Gitcoin, Obol, and Compound, to name a few, to provide seamless access to onchain structured products, sourcing the best quotes from multiple OTC desks and settling fully onchain.

A significant advantage of executing these strategies via MYSO is the ability to settle all trades natively on Scroll. This eliminates the operational complexity and security risks associated with bridging SCR tokens to other chains or using third-party custodians. The entire process is decentralized, trustless, and transparent, avoiding counterparty risk while retaining full asset control.

With MYSO, the DAO would not only gain access to a powerful treasury management tool, but also bring liquidity, volume, and institutional adoption as trading firms need to interact with MYSO on Scroll, as well as potentially attract in new users:

-

Boost On-Chain Activity: Every trade, from premium payment to final settlement, occurs directly on Scroll, contributing to its transaction volume and network effects.

-

Enhance the Ecosystem: Introducing a sophisticated structured products protocol like MYSO provides a new, valuable DeFi primitive for other projects and users on Scroll.

-

Maintain Sovereignty: The DAO’s assets remain on their native chain, under full control at all times.

Deploying the MYSO v3 protocol to Scroll is a straightforward process that can be handled by the MYSO team, typically within a few days. We are prepared to facilitate this deployment at no additional cost to the Scroll DAO, contingent on an agreement to utilize the protocol for a portion of its treasury management strategy.

The protocol consists of two core smart contracts: the Router and the Escrow Implementation Contract. These contracts are publicly available in the official MYSO V3 repository and have been thoroughly audited (forum won’t allow us to include more links but it’s all accessible via the website MYSO.finance).

Other Potential dApp Deployments to Consider

Enzyme: Cross-Chain Vault(s) with Rev Share

While deploying treasury assets for yield generation is one source of revenue for the DAO, another accessible source we believe worth considering are Scroll-native vault strategies with a revenue-share agreement. This revenue could conveniently be distributed to the Foundation (being a central entity) as a rebate and reduce funding reliance and burden on the DAO, thus supporting both the DAO’s and Foundation’s financial sustainability.

As an example, a new version of Enzyme (Enzyme Onyx) is set to launch sometime in September/October, and will allow for easy deployment and broad cross-chain capabilities out of the box. This opens the door for innovative vault strategies that could be monetized by the DAO/Foundation as a source of revenue to support financial sustainability, while deposits and trading activity occurs natively on Scroll to boost DeFi activity.

All else being equal, deploying Enzyme Onyx can be done within a day or two free of charge for the DAO.

That said, Avantgarde remains infrastructure agnostic and are happy to discuss other/additional protocols where we could build dedicated products for the DAO/Foundation.

Morpho: Seeding a Curator Ecosystem

Adding a Morpho deployment is one potential avenue to deepen the existing lending markets on Scroll and draw capital and users looking for permissionless lending infrastructure to complement the current protocols available. As an already established curator on Morpho, Avantgarde could seed a vault curator ecosystem on Scroll, building a foundation for other curators and fostering the liquidity flywheel via this intermediation layer. A healthy curator environment could aggregate lending to support borrow demand, and provide a platform for tokens from emerging projects within the Scroll ecosystem as collateral.

5. Accounting, Reporting and Financial Planning

Accurate, transparent accounting is the foundation for effective treasury management. Without it, strategic decisions lack the necessary financial context.

To deliver this, Avantgarde propose to engage Regen Financial – a leading digital asset accounting firm trusted by projects such as Fluent, Polygon, and Arbitrum.

Together, Regen Financial and Avantgarde will conduct a comprehensive review of Scroll’s financial accounts. This will involve importing all on-chain transactions into best-in-class web3 subledger software and integrating them with a traditional accounting ERP to produce the following deliverables:

-

Year-to-date accounts review and update – full reconciliation of transactions to ensure accuracy.

-

Genesis to Date Financial Report – analysis of historical transactions, income and expenditure, cash flow forecasts, and existing liabilities.

-

Monthly accounting – automated processes to improve speed, accuracy, and efficiency going forward.

-

Quarterly financial reports & financial planning – including Income Statement (P&L), Balance Sheet, cost analysis, revenue mapping, runway analysis, and scenario-based forecasting.

As an example, Regen Financial have been supporting Arbitrum DAO with a similar service over the last 12 months. Please see the latest July 2025 Financial Report here.

Together, this work will give the DAO a clear view of its current financial position and the tools to assess the long-term impact of strategic decisions and major initiatives/events, strengthening treasury management and supporting a sustainable financial future.

Submission Guidelines

Submission Guidelines Community Feedback

Community Feedback