kpk Treasury Management Proposal

Table of Contents

Summary

Overview

Specification

Treasury Analysis

SCR Market Today

Market Stats (& 60d variation)

Treasury Management Strategy

Risk Management

Technology Stack

Funding

Termination

Conflicts of Interest

Disclaimer

Summary

This proposal outlines a collaboration between kpk and Scroll, focused on managing Scroll’s Treasury.

If approved, kpk will non-custodially manage ~20M SCR before Oct-2025 and ~20M additional SCR once they are unlocked in October. The treasury will gradually diversify by accumulating stablecoins through strategies defined by kpk’s research team, within our strict risk-management framework. This will allow Scroll to extend its runway and cover its expenses without selling SCR, increasing the capability of the treasury to fund future initiatives and retribute its contributors with stablecoins.

Scroll DAO retains the right to terminate this agreement through its governance mechanism.

Overview

About the Scroll Protocol

Scroll is the most performant ZK Layer 2 scaling solution in the industry, designed to enhance the performance and scalability of the Ethereum network. It leverages zero-knowledge rollups (zk-rollups) to enable fast and cost-effective transactions on the Ethereum blockchain, without compromising decentralisation or security.

Scroll employs a multifaceted approach to ensure its security, relying on the robustness of battle-tested cryptographic libraries and the principles of open-source development. This approach is designed to maintain the integrity and safety of its zkEVM-based zkRollup on Ethereum, which is crafted to offer native compatibility for existing Ethereum applications and tools.

The SCR token is the native currency of the Scroll network. It is used for rewards within the ecosystem and governance purposes. Scroll’s technology enables the platform to scale without sacrificing security, as every transaction executed on Scroll is accompanied by cryptographic proofs validated on Ethereum.

The Scroll network is 100% EVM-compatible, minimising Dev adoption friction. This has contributed to garnering over 700 builders who have developed over 100 dApps. It has negligible gas fees and over 116M transactions to date.

The DAO’s main wallet currently holds 95,985,136 SCR, with a nominal dollar value of $35.6M to date (18-Aug-25). Details on the total token supply allocation can be found in the DAO’s tokenomics.

About kpk

Founded in 2020, kpk is a DeFi-native organisation specialising in on-chain finance. We help our partners grow their operations, deploy liquidity, and invest prudently for their organisations’ long-term success and sustainability.

kpk is the market leader in non-custodial asset management, working with many leading DAOs, including GnosisDAO, Balancer, ENS, CoW Protocol, Aave, SAFE, Arbitrum, Uniswap, and Lido. We’ve also been appointed as advisors on treasury and DeFi policy by the Ethereum Foundation.

The total value of our partner treasuries exceeds $1.5B, and we currently manage over $1B in non-custodial AUM. To date, kpk has executed over 10,000 DeFi transactions for multiple partners with zero security incidents.

We focus on supporting our partners through the various stages of their growth. Concerning case studies, we have helped ecosystem strengthening through GNO large-scale buybacks, contributed to GHO’s growth to over $100M market cap, forecasted Balancer’s OpEx, managed the ENS endowment, served as a committee member for the Arbitrum Stable Endowment Program, and analysed the Uniswap Treasury as part of the Uniswap Treasury Working Group, among others.

We have experience working with DAOs with treasuries constituted exclusively by their native token, such as dYdX and Nexus Mutual, with positive results.

For dYdX, we have accumulated a gross revenue of $2.49M, comprised of Staking Rewards ($1.06M) and Revenue Share from the Buyback Program ($1.44M).

For Nexus Mutual, we implemented a strategy based on a concentrated liquidity position on Uniswap V3—designed to only activate if price moved into range, generate trading fees while price sat outside our mandate and sell gradually with minimal price impact. The treasury has increased from $6.68 million at the end of October to $9.28 million as of the end of November.

We have also successfully executed a TWAP swap strategy for ENS, which saved $2.36m.

Specification

This proposal outlines the initial scope of a strategic collaboration between kpk and Scroll to:

- Enhance its financial sustainability,

- improve the capital efficiency of its treasury,

- and explore business opportunities with other Web3-native organisations to strengthen the Scroll ecosystem by offering users more attractive DeFi alternatives within the network.

These three pillars will help Scroll achieve its mission of building an open economy anchored by security and driven by performance.

As Scroll’s treasury diversifies, exposure to SCR volatility will gradually be reduced, limiting the impact of market downturns that could force the DAO to sell SCR at low prices. As the portion of stablecoins grows, the guaranteed DAO’s runway will extend, allowing SCR to fund its programmes and retribute its contributors independently from potentially adverse market conditions.

Our team would begin by drafting an Investment Policy Statement to outline the objectives and strategies for managing Scroll’s treasury. This statement will serve as a roadmap to ensure disciplined and consistent decision-making aligned with Scroll’s goals and long-term vision.

More information about our approach and rationale behind Investment Policy Statements can be found here.

The key initiatives of this collaboration include:

- Asset Management Infrastructure:

- Deploy non-custodial asset management infrastructure.

- Implement automated risk management tools prioritising the safety of Scroll’s funds.

- Treasury Management:

- Explore treasury diversification to create value and reduce concentration risk. Diversifying SCR tokens will improve the DAO’s risk management and capacity to generate yield.

- Allocate treasury funds into DeFi strategies that offer risk-adjusted returns to turn the treasury into a source of income for Scroll DAO.

- Provide detailed and regular monthly reports on Scroll Treasury’s asset allocation and performance.

- Publish semestral performance reviews, including next steps, e.g. Balancer H1 2025 review, Nexus Mutual June 2025 review, Gnosis DAO 2025 H1 review, ENS H1 2025 review, etc.

- Financial planning:

- Supporting the DAO in forecasting and optimising expenses and suggesting non-operating revenue streams to ensure the buildup of stablecoin reserves. Our long-term target is to reach 18 months of secured runway to be prepared for bear markets and ensure fulfilment of financial obligations with grantees and service providers.

- Governance Participation: DAO engagement and transparency

- Our team will actively report and engage with DAO members regarding its contributions to Scroll’s financial well-being. We are committed to supporting Scroll’s evolving goals and needs with our experience and expertise, while being receptive to community suggestions.

Treasury Analysis

Scroll DAO’s treasury holds ~95.9m SCR (worth ~$35.6m @ $0.3731 as of Aug-18). These are the 10% of SCR dedicated to “Scroll DAO Treasury” in the DAO’s tokenomics.

Below is an analysis of the current market status of SCR and an array of DeFi / Partnership strategies we could push for.

SCR Market Today

- All SCR tokens are in Scroll Mainnet (L2).

- There is a total supply of 1B tokens, which is fixed and will not change over time.

- 94.5% of SCR are held in the top 10 addresses (and variation vs. 60 days ago):

| Address | Name | Current Allocation (M) |

| 0x212499E4E77484E565E1965Ea220D30B1c469233 | Scroll Core Contributors Safe (23%) | 229.481 | = |

| 0xeE198F4a91E5b05022dc90535729B2545D3b03DF | Ecosystem Safe (25%) | 178.107 | ↓ |

| 0x206367ebD1fB54F4f33818821Feab16F606eEbB7 | Investors Safe (17%) (1y cliff, 4y vest) | 170.518 | ↓ |

| 0x4cb06982dD097633426cf32038D9f1182a9aDA0c | Scroll DAO Treasury Safe (10%) | 95.985 | ↓ |

| 0xfF120e015777E9AA9F1417a4009a65d2EdA78C13 | Scroll Foundation Safe (10%) | 88.873 | ↓ |

| 0x86E3730739CF5326eEba4cb8a2bf57Dd91a2E455 | Airdrops Safe (15%) | 85.324 | = |

| 0xF977814e90dA44bFA03b6295A0616a897441aceC | Binance hot wallet 20 | 55.910 | ↓ |

| 0xf89d7b9c864f589bbF53a82105107622B35EaA40 | Bybit hotwallet | 12.910 | ↑ |

| 0x321A613092Ab76418ab137D58C34BCcFB2c61f67 | No ID | 10.265 | ↑ |

| 0x611f7bF868a6212f871e89F7e44684045DdFB09d | No ID | 5.763 | = |

Source: https://scrollscan.com/token/tokenholderchart/0xd29687c813d741e2f938f4ac377128810e217b1b

Market Stats (& 60d variation)

FDV: $295.9M (total supply * price) | ↓ 9.1M

Market cap: $56.21M (circulating supply * price) | ↓ 1.73M

Circulating Supply: 190M SCR | =

Liquidity: $196.49K (Total dollar value for tokens available for trading on DEXs, accessible through liquidity pools) | ↓ 21.47K

Token age: 10 months (since launch)

- 24h Volume by CEX:

- HTX: 27.6M SCR or $10.39M

- Binance: 18.6M SCR or $7.09M

- MEXC: 8.39M SCR or $3.15M

- Gate: 4.58M SCR or $1.72M

- OKX: 3.71M SCR or $1.40M

- LBank: 4.26M SCR or $1.60M

- WhiteBIT: 1.74M SCR or $659K

- Bybit: 1.78M SCR or $668K

Treasury Management Strategy

This strategy proposes a structured, long-term plan for managing the DAO’s SCR holdings to achieve diversification, yield generation, and ecosystem growth while maintaining responsible execution and on-chain custody.

1. Gradual Stablecoin Diversification via CEXs

kpk will design and establish the infrastructure required to enable the DAO to conduct off-chain activities in a compliant and secure manner, including centralised exchange (CEX) operations. This framework will act as a legal wrapper that allows kpk, the Scroll Foundation, and community members to collaborate effectively under a clear governance structure.

If the proposal is accepted, kpk will bootstrap a dedicated legal entity to serve as the DAO’s legal wrapper. This entity will provide the necessary legal personality to:

- Open and manage institutional accounts on centralised exchanges on behalf of the Scroll DAO.

- Enter into agreements with service providers, custodians, and counterparties as required.

- Facilitate treasury operations that cannot be executed exclusively on-chain, while maintaining transparency and accountability to the DAO.

kpk will subsidise the costs associated with the initial setup of the legal wrapper as a signal of our long-term commitment to the Scroll community. The entity will be structured to align with the DAO’s decentralisation, transparency, and accountability principles, while ensuring that treasury operations are legally robust and scalable as Scroll continues to grow.

To execute CEX operations efficiently, kpk uses professional-grade execution engines and market-making algorithms designed to:

- Drastically reduce market impact during trades.

- Source the deepest available liquidity (currently onboarded on Binance, with scope for expansion).

- Benefit from the lowest possible transaction fees, as most orders are executed as maker orders.

- Maintain close to zero stable-to-stable conversion fees.

- Provide transparent analytics and reporting, similar to our published buyback program statistics.

To date, we have successfully executed $2.5M+ in trading volume with less than 0.1% in effective fees using these algorithms, demonstrating both efficiency and scalability.

Based on our simulations, the progressive conversion of Scroll DAO’s SCR into stablecoins via centralised exchanges over 18 months would suffice to achieve the goals detailed under the following execution parameters.

Execution parameters:

- Allocation: 60% of the treasury (~24M SCR)

- Execution horizon: 1.5 years

- Max daily sale: Capped at 2% of daily trading volume on whitelisted CEXs.

- Slippage control: Trades will follow market-making best practices (e.g. limit orders, timing) to avoid impacting price.

With an execution horizon of 18 months, and Binance as the only CEX we could operate on, we estimate average daily orders of around $22k (approximately $620k per month), allowing us to reach a target of $8.5M before the end of the target execution horizon.

If the execution horizon is shortened to 12 months, under the same CEX limitation, the $8.5M target could still be achieved by increasing the average daily sell size to roughly $29k (about $870k per month).

This approach is inspired by Nexus Mutual’s execution model, which combined gradual sales with smart order placement to stay within price tolerance thresholds.

In a second phase, after analysing Scroll’s cash flow, we will determine a threshold at which additional diversification into ETH and WBTC will begin. We will save these as strategic assets to secure Scroll’s long-term growth and leverage their upside potential.

2. Covered Calls

20% of the SCR treasury (~19.2M SCR) will be allocated to writing covered calls on MYSO Finance or equivalent decentralised options protocols supporting Scroll mainnet.

This strategy collects stablecoin premiums from users who purchase call options on SCR. It allows the DAO to generate recurring yield with no upfront sale of assets unless exercised.

Execution parameters:

- Allocation: 20% (~8M SCR)

- Income source: Monthly option premiums (estimated ~$28,000/month, although subject to market changes and counterparty quotes)

- Strike levels: Initially targeting 20–50% above market to reduce exercise probability.

- Execution risk: The DAO retains full control of its SCR unless options are exercised. In that case, the Treasury effectively sells SCR at a predefined price, without impacting open markets—similar to an OTC settlement.

3. On-Chain Liquidity on DEXs

The remaining 20% (~8M SCR) will bootstrap SCR-based liquidity pools on Scroll-native decentralised exchanges, improving the market sentiment. Stablecoins acquired through strategies (1) and (2) will be paired with idle SCR to deploy into liquidity pools.

Initially, kpk will be responsible for deploying and providing liquidity on:

- SyncSwap (simple and efficient AMM for stable and volatile pairs, with routing optimised for Scroll liquidity)

- Maverick (dynamic liquidity pools with flexible modes for execution efficiency and yield optimisation)

The design ensures SCR liquidity grows in tandem with the treasury’s diversification progress, creating an organic loop between off-chain sales and on-chain liquidity. Additional protocols will be explored during our tenure.

**Custody note:

**For Strategies 2 and 3, SCR and stablecoins will be held in a Scroll Mainnet Safe with non-custodial module control.

Recap table:

| Strategy | Allocation | Source of Income | Custody |

| Gradual CEX Sales | 60% | SCR-to-Stablecoins conversions | Off-chain CEX (on a specific framework) |

| Covered Calls | 20% | Monthly option premiums | Gnosis Safe (on-Scroll) |

| On-chain Liquidity | 20% | LP fees + SCR value accrual | Gnosis Safe (on-Scroll) |

Execution Path Forward

- Confirm which CEXs are approved for SCR sales.

- Define treasury mandate & limitations for asset sales.

- Deploy infrastructure to manage assets according to each strategy.

- Deploy the first round of covered call positions via MYSO.

- Begin stablecoin pairing from strategies (1) and (2) into on-chain liquidity pools deployed by kpk on Balancer and Uniswap V3.

- Monitor performance monthly and rebalance between strategies as needed.

This plan aims to deliver a responsible diversification timeline, stablecoin yield, and native liquidity growth—without compromising DAO control or triggering adverse price impact.

Adaptable Strategies

Given the active nature of our treasury management approach, if market conditions vary, we will have the flexibility to adapt our strategy to stay within risk and performance targets through simulated A/B testing, ensuring capital preservation and liquidity while generating sustainable yield. This could include different strategies, such as yield generation using stablecoin pairs, that could be deployed throughout whitelisted assets and protocols curated by our team.

Risk Management

Safeguarding Scroll’s assets is our utmost priority.

kpk’s risk management framework has been battle-tested through over 10,000 transactions without a single security breach, underscoring the robustness and reliability of our approach.

We have developed bots that allow us to react instantly to unexpected market downturns that could trigger liquidations of collateralised positions, repaying debt promptly. We conduct periodic emergency drills following regularly updated emergency protocols to de-risk positions in the event of a hack or black swan event that could result in loss of funds. Our OPSEC follows strict industry standards that have been externally audited.

Our multi-layered risk management strategy encompasses:

- Rigorous Counterparty Assessment: We conduct thorough due diligence on all counterparties and platforms before deploying funds. Our team evaluates each entity’s security, reliability, and reputation to mitigate counterparty risks.

- Robust Technology Stack: kpk’s proprietary technology stack has been extensively stress-tested in live market conditions. Our secure, transparent, and auditable systems ensure the integrity of all treasury-management actions.

- Continuous Monitoring: Our team monitors market conditions, positions, and potential threats in real time. This vigilant oversight allows us to swiftly identify and respond to adverse events, protecting all managed assets.

- Strategic Diversification: By allocating funds across multiple yield-generation strategies and platforms, we mitigate concentration risks and ensure a well-balanced exposure to market opportunities.

- Proactive Scenario Planning: Our team continuously models potential market scenarios and develops contingency plans to navigate periods of volatility or uncertainty. This proactive approach allows us to adapt quickly and preserve capital in challenging conditions.

- Rigorous Internal Controls: kpk maintains strict internal controls and segregation of duties to prevent unauthorised actions and ensure the integrity of all treasury-management activities.

By combining these risk management measures with our proven expertise and track record, kpk can provide Scroll with a robust framework for securing and growing its treasury assets in the dynamic DeFi landscape.

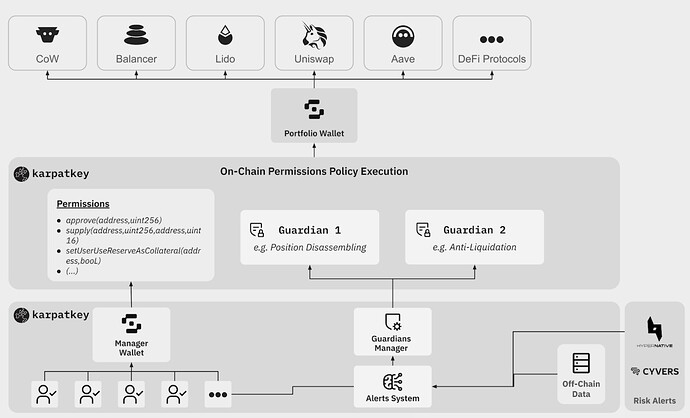

Technology Stack

Our technical infrastructure is designed to provide robust security and control mechanisms for our treasury management operations. By leveraging a multi-layered approach, we ensure the safekeeping of our clients’ assets while maintaining efficient execution capabilities.

Custody and Permissions Layers

At the foundation of our system, we leverage industry-standard Safe smart accounts to securely custody our clients’ funds. Each client has a dedicated Safe that they fully control.

We have developed a custom permissions layer based on the audited Zodiac Roles modifier to provide fine-grained control over treasury activities. This allows our clients to approve specific actions to be executed on their funds, ensuring that our asset managers can only complete the authorised operations.

We have created specialised tooling to generate these permissions (Policy Builder) and construct the necessary on-chain transactions (Transaction Builder) for execution.

Execution Mechanisms

Asset managers execute approved transactions directly through the permissioned Smart Accounts. This process is accessible through a dedicated and decentralised application interface, where asset managers can propose permissions and execute actions through a secure web-based platform.

Risk Management Tech

To mitigate risks from within our tech stack, we have implemented a multi-layered approach:

- Alerts System: We have partnered with leading security monitoring providers, such as Hypernative and Cyvers, to set up customised alerts on our clients’ portfolio positions. These alerts trigger our automated response mechanisms.

- Automated Guardians: Our automated guardians are bots that continuously monitor client positions. When an alert is triggered or predefined thresholds are reached, these guardians can automatically execute predefined actions to manage the positions and safeguard the assets.

- Agile Execution: As a final line of defence, our asset management portal provides an “agile execution” feature, which allows our asset managers to rapidly disassemble complex positions with a single click in case of market emergencies or protocol exploits.

This multi-layered approach, combining alerts, automation, and rapid response capabilities, ensures that we can effectively mitigate risks and preserve the integrity of our clients’ treasury assets.

An essential aspect of introducing the Roles Modifier is aligning with the core DeFi strategies to be enabled. Through governance, the DAO will grant the appropriate permissions for kpk to enact these strategies. These strict guardrails will define the scope of the treasury strategy.

To ease the implementation, kpk can deploy the Safe and the initial configuration. Once the Roles Modifier is fully configured and tested, kpk will transfer ownership back to Scroll, and the Scroll DAO treasury will fund the Avatar Safe. This will enable kpk to allocate treasury funds through the Manager Safe multisig.

Monitoring and Reporting

As part of our efforts to maximise transparency and visibility to the DAOs with which kpk collaborates, a Scroll DAO report will be created. This report will show a detailed description of the treasury’s assets and DeFi allocations and the evolution of their economic value. Similar reports for other DAOs can be found on kpk’s reports site.

Funding

In order to support Scroll’s long-term growth, kpk requests a 0.5% management fee on the invested assets under non-custodial management and a 20% performance fee on the yield generated.

- The management fee is to be paid in USDC in monthly instalments, calculated as allocated treasury funds * 0.005 / 12 (evaluated at 23:59 UTC on the last day of each month)

- The performance fee will be paid in USDC on a monthly basis.

To accommodate for the volatile nature of crypto markets while ensuring a steadfast service level, we introduce a minimum fee of $90k per year.

Termination

Scroll DAO may terminate the engagement under this agreement for any reason by its Governance Mechanism at any time after the first 12 months. kpk DAO may terminate this agreement upon four weeks’ notice posted as a new discussion thread in Scroll’s forum. Regular fees will be collected until the day of termination.

Conflicts of Interest

kpk has no conflicts of interest related to our appointment as Scroll Treasury Managers.

Disclaimer

The above-mentioned are strategy examples. These strategies don’t intend to be and do not constitute financial, investment, trading, or any other advice.